The calculation of payrolls, if not automated, is a complicated but necessary method. Although the pay method varies from one corporation to another, certain elements, including taxes and standard deductions, remain consistent. Some employees have never grasped their payslips and have different questions for the team in human resources. This leads to confusion and sometimes triggers resentment on the deductions of staff. To eliminate any such occurring that can create any miscommunication, opting for HRMS Software is the most ideal solution to structure the salary possess of your employees and to derive your CTC(Cost to Company) package.

The calculation of payrolls, if not automated, is a complicated but necessary method. Although the pay method varies from one corporation to another, certain elements, including taxes and standard deductions, remain consistent. Some employees have never grasped their payslips and have different questions for the team in human resources. This leads to confusion and sometimes triggers resentment on the deductions of staff. To eliminate any such occurring that can create any miscommunication, opting for HRMS Software is the most ideal solution to structure the salary possess of your employees and to derive your CTC(Cost to Company) package.

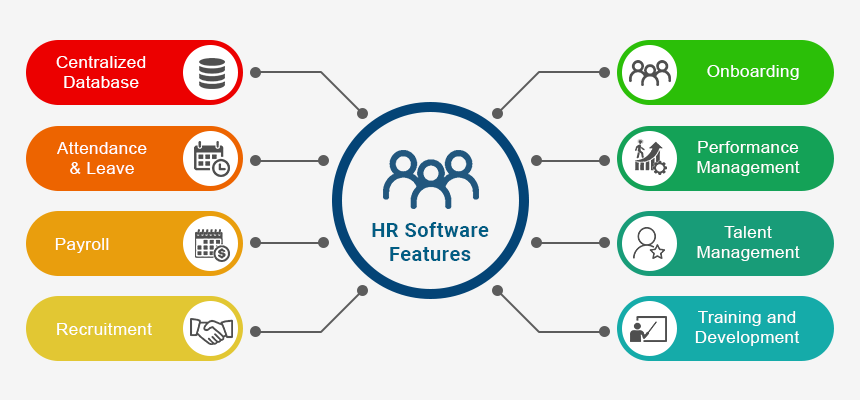

Your organization’s payroll processing could be completely automated by HRMS Software. The application helps to describe your remuneration, attendance, leave, overtime, and wage care according to the rules. You can process your employees’ salaries without any intervention once you have completed the integration of payroll software and can completely avoid disruptions, cut costs & increase employee satisfaction. It can perform a variety of tasks dynamically and reliably, from wage processing to the extraction of payment and expense reports and tax calculations.

- Software for payroll processing can be personalized to any form of business. You can also add various divisions to maximize the company’s use of software data and update the details of all personnel.

- The most prominent feature is the ability to adjust or alter wage calculations depending on the financial circumstance. This is achieved by adjusting tax and reimbursement formulas.

- The payroll management system helps you to quickly create paychecks for all employees. On these bills also are added all calculations required, such as taxes and allowances/benefits. It is also quick to print the payslips.

- The software also helps to regulate your workers indirectly, notably in terms of job performance and leave condition, and associated attendance records. Some software also provides leave encashment and credit repayment solutions.

- It helps you to manage more business with less work by streamlining number crunching, report generation, and customer contact. An efficient payroll system would have a stringent security mechanism that won’t permit employee theft.

Not only does payroll software aids in assessing salaries, but it also provides you with updated statistics on the overall cost of employment and keeping a record of the individual employees as well. You can choose suitable payroll software for your organization based on the scale of your corporation and use cases. Every financial activity, including payroll data such as department-wise employee expenses, individual payroll components such as reimbursements, tax due and charged, etc., must be reported by your accounting/ERP system. Some payroll software has integration with accounting software via API( a way to push data directly from one software to another). The HR manager will have to provide the accounting department with all transaction records in the lack of such integration. The auditor then manually updates it to auditing applications such as Tally ERP, SAP, Quickbooks, etc. in the form of a general ledger. These integrations will assist the financing and payroll team to work together and prevent any manual data entry.

Peopleworks is a cloud-based HCM software. With its innovative embedded applications such as core HR, attendance & leave management, monitoring, and employee self-service portal module, it optimizes and automates payroll. It can also be equipped with accounting software and matrix-like attendance authentication protocols.